Explore the transformative world of Decentralized Finance: opportunities, risks, and trends shaping its future. Dive into the vibrant DeFi landscape today.

Decentralized Finance (DeFi): Opportunities and Risks in the Current Landscape

Decentralized Finance (DeFi): Opportunities and Risks in the Current Landscape

In recent years, the financial industry has witnessed a transformative shift with the rise of Decentralized Finance (DeFi). This innovative technology is altering how we interact with money, credit, and investing, and it has opened a world of possibilities alongside significant challenges. This blog post delves into the current DeFi landscape, exploring opportunities, potential risks, and what the future holds for this revolutionary financial ecosystem.

Understanding Decentralized Finance

Decentralized Finance, commonly known as DeFi, refers to a collection of blockchain-based financial services that function without traditional bank intermediaries. By leveraging smart contracts—self-executing contracts with the terms of the agreement directly written into code—DeFi platforms can offer services such as lending, borrowing, and trading on decentralized networks.

Exploring DeFi Opportunities

DeFi presents a myriad of opportunities for individuals and businesses alike. Here are some of the most compelling:

1. Accessibility and Inclusivity

DeFi platforms eliminate the need for intermediaries, offering financial services to anyone with an internet connection. This enhances financial inclusion, particularly for individuals in regions with limited access to traditional banking.

2. High Yield Investment Avenues

DeFi offers lucrative opportunities for those looking to invest in multiple assets. Yield farming, liquidity mining, and staking are popular strategies for earning high returns on digital assets. The potential for high yield makes DeFi investment extremely attractive to many.

3. Innovation in Financial Products

The decentralized nature encourages the rapid development and deployment of innovative financial products. From synthetic assets to decentralized exchanges, the current DeFi landscape fosters a creative environment for developers and entrepreneurs.

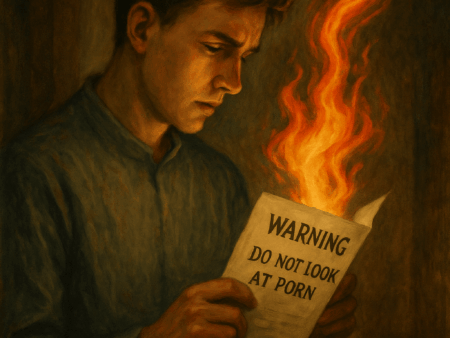

Navigating DeFi Risks

Despite the numerous opportunities, DeFi also poses significant risks that investors and users must be aware of:

1. DeFi Security Risks

The rapid growth has made DeFi platforms targets for cyberattacks and fraud. Hacks, phishing scams, and code vulnerabilities are notable threats. Enhancing DeFi security requires ongoing auditing and development efforts to mitigate these risks.

2. Regulatory Uncertainty

The ever-evolving nature of DeFi presents challenges in terms of regulatory compliance. Many countries are still formulating rules regarding crypto and DeFi, contributing to a landscape of uncertainty and potential legal complications.

3. Market Volatility

DeFi investments can be highly volatile, subject to the whims of the broader cryptocurrency market. While opportunities for gains are substantial, the potential for losses is equally significant.

The Future of DeFi

As we look ahead, the future of DeFi appears both promising and challenging. Key decentralized finance trends include:

1. Integration with Traditional Finance

There is potential for DeFi to integrate with traditional finance, creating hybrid solutions that leverage the benefits of both systems. This could bridge the gap between conventional banks and blockchain technology.

2. Focus on Security and User Experience

Improving security measures and enhancing user experience are paramount for the growth of DeFi. As more users adopt these platforms, ensuring their safety becomes critical.

3. Regulatory Developments

Governments and regulatory bodies worldwide are increasingly interested in DeFi. Their involvement could lead to clearer frameworks that might encourage more widespread adoption while ensuring protection for users.

Conclusion

The surge in decentralized finance innovation represents both an exciting opportunity and a formidable challenge. While users and investors can benefit from new financial tools and lucrative prospects, they must also navigate various DeFi risks inherent in this rapidly evolving ecosystem. By staying informed and vigilant, the future of DeFi holds immense potential for reshaping the financial landscape.